Real Estate

By selecting Ballard Built (BBP), you’ll be empowered to join forces with leaders in the residential development world.

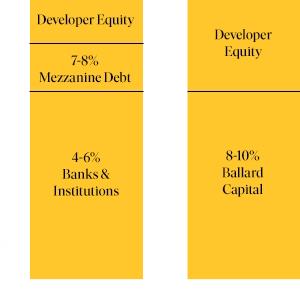

The BB program was designed for a shorter-term investment strategy. It offers the protection of being collateralized by active construction projects. This is for the investor who wants a great return but needs convertibility and recall of funds on a shorter time horizon. Each investment is placed in a specific deal or project and not an overall company-wide fund. This allows for capital recall at deal maturity for easier return of funds.

6% RETURNS

6% returns

12% targeted overall returns

Summary

![]()

Initial 6% annualized return pref

![]()

PLUS an additional 6% of invested amount at sell of asset [real estate sale – not guaranteed, it is profit participation]

![]()

9-18 mo investment term cycle with roll-over availability

![]()

Minimum investment of $100K